If you’ve made a 2024 New Year’s resolution to become wealthy, you should prepare to take full control of your finances and be willing to make changes to your habits. Whether you have large debt payments, a tendency to overspend or limited income, several roadblocks can make it harder to save and grow your money to reach your goals.

Rachel Cruze: 15 Things To Sell in Your Home To Make Money

Side Gig: Earn Up To $200/Hour With This Easy-To-Start Job, No College Degree Required

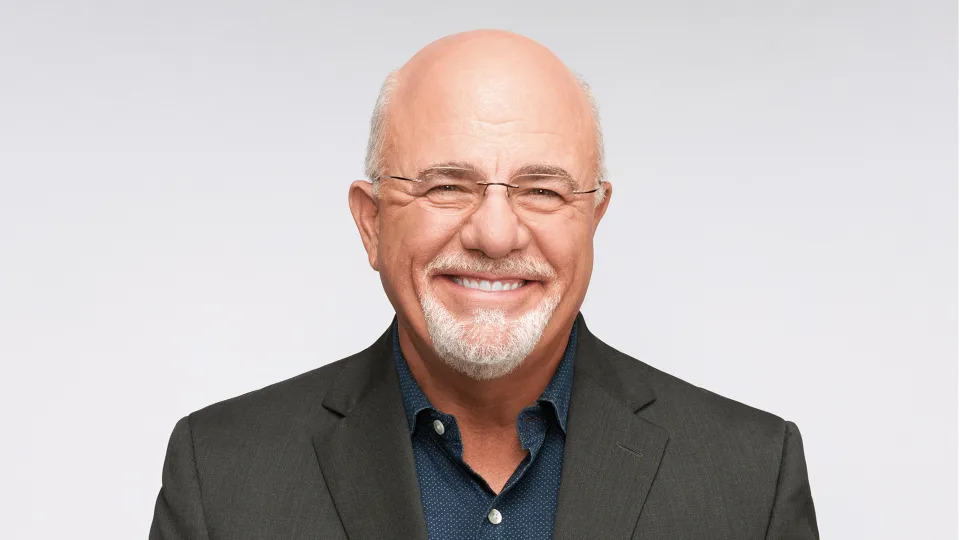

Known for his national radio show and books on money management, Dave Ramsey frequently gives advice on becoming rich and avoiding common money mistakes. In a post on his Ramsey Solutions website, the personal finance expert unveiled five things that you can do to start building wealth in 2024.

Sponsored: Get Paid To Scroll. Start Now

Get a Budget

Ramsey explained that it’s unreasonable to think you’ll manage your money well without a plan. Instead, you should have a zero-based budget that puts each dollar to use and is easy to follow.

With this method, you allocate money toward your expenses, debts and savings and investment goals until the income left is zero. This can take some trial and error when you encounter shortages or excess funds. Ramsey offers a free template with instructions and tips on his website.

Be sure you follow your budget to increase your chances of getting wealthy. Since you might find it too much work to budget by hand, look into tools that can make the process more convenient, such as Ramsey’s EveryDollar app. Don’t forget to revise the budget when your financial circumstances or goals change.

Don’t Have Debt

In a post on the X platform, formerly known as Twitter, Ramsey wrote, “Your most powerful wealth-building tool is your income.” He explained that becoming wealthy is hard if you’re paying off creditors. Escaping and avoiding debt will free up cash for goals and avoid the costs of future fees and interest.

You can try the recommended debt snowball plan to wipe out your debts by size, beginning with the smallest one. Taking on a second job, cutting expenses and following your budget can speed up the payoff process. For future expenses, try to save up enough so you can pay in cash and not need to turn to credit cards and loans.

Stop Spending Beyond What You Earn

Using your income unwisely will not only hinder you from becoming wealthy but may also send you into debt. Ramsey emphasized how it’s important to not just spend your entire paycheck or waste it on lavish things. Instead, make smart decisions and find ways to save when you can, including using coupons and shopping around.

In a radio show clip on YouTube, Ramsey spoke about the related issue of stagnant wages. He suggested taking control and finding better job opportunities rather than waiting for the government to help. That way, you’ll have more cash for building wealth.

Build Your Retirement Fund

Using a budget, spending wisely and escaping debt will put you in a good position to start saving and investing money. Ramsey explained you should first fill up an emergency fund.

Next, focus on a Roth IRA or 401(k) account where you’ll save 15% of your gross yearly wages and see your money significantly grow over the years. The earlier you can start doing this, the better.

Consider setting up automated contributions and saving more when possible. Just be mindful of yearly contribution limits for retirement accounts and explore supplements such as brokerage accounts. Some tips for boosting your retirement contributions include taking advantage of employer matches, living frugally and diversifying your income.

Generously Give To Others

Ramsey mentioned in his post, “When you write a plan for your money, get rid of debt, live on less than you make and start investing for the future, you can be as generous as you want to be and help change the world around you.” Although it often involves parting with some of your money, giving can greatly enrich your life and provide intangible wealth.

You can consider several ways to give money in a way that’s meaningful. For example, you might decide to donate to a charity that supports a cause close to you or your loved ones, or you could give directly to someone you know in need. Besides giving money, you could always do volunteer work for a community organization

No comments:

Post a Comment